External Bank Accounts

Add and verify external bank accounts to process ACH

An External Bank Account is a bank account outside of Lithic that your program can send funds to or receive funds from via ACH. To set-up an External Bank Account, you will provide information about the bank account and its owner. Most programs will verify ownership of that bank account via micro deposits, while some will have the ability to verify the bank accounts information via prenotifications (also known as prenotes) or via their own external verification method. Once the external bank account has been verified, your program can then collect from and send funds to this account using ACH originations initiated via Lithic's Payments API.

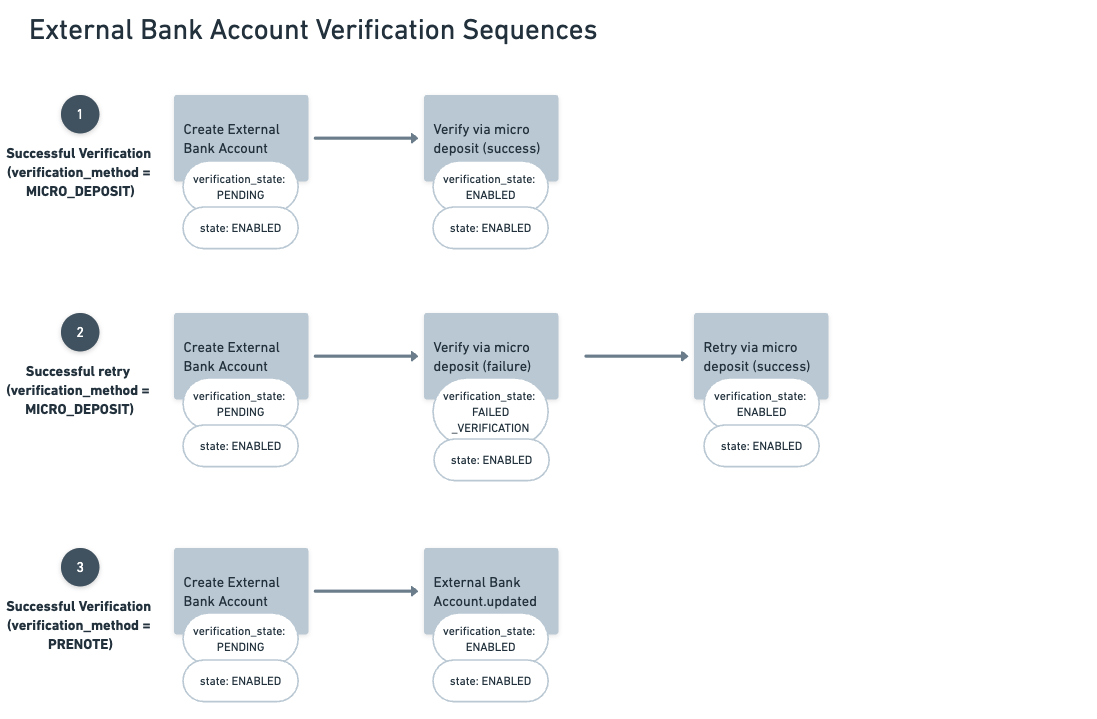

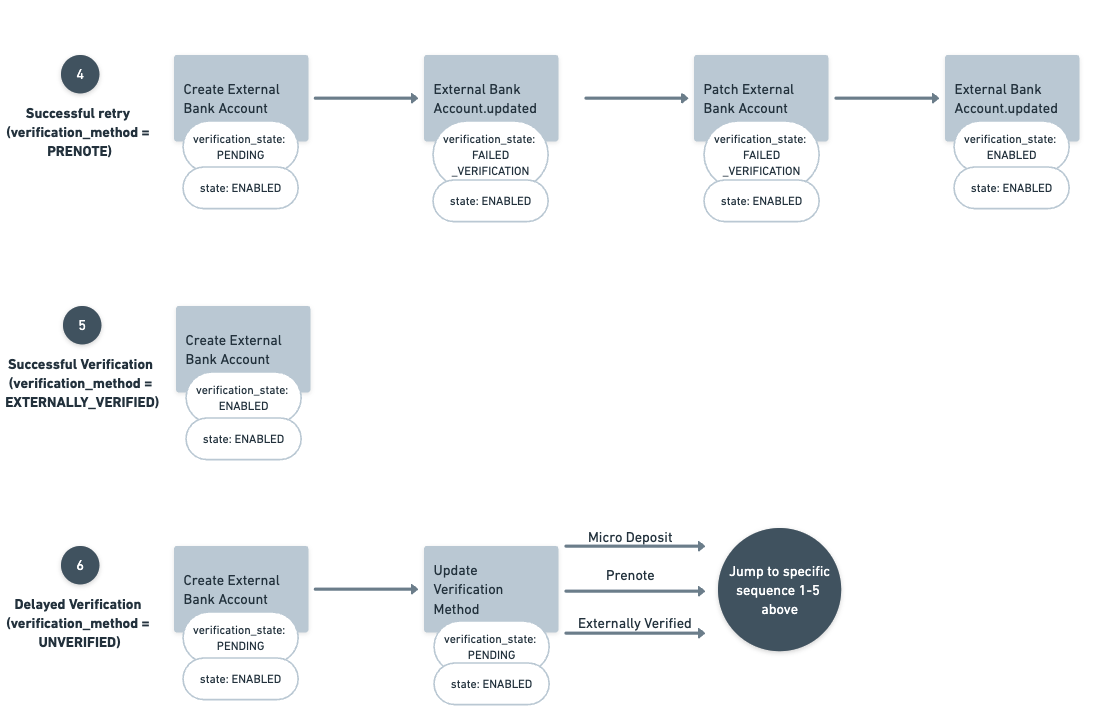

Verification Methods

Lithic currently offers three methods to verify ownership of an External Bank Account: MICRO_DEPOSIT, PRENOTE, or EXTERNALLY_VERIFIED.

MICRO_DEPOSITverifies a bank account using 2 small dollar deposits and 1 small dollar withdrawal via ACH. This method works on all bank accounts but generally takes 1-2 business days to complete.PRENOTEverifies a bank account using a zero-dollar transaction via ACH. Prenotes validate the information of the bank account but do not verify ownership.EXTERNALLY_VERIFIEDrequires the program to verify the external bank via their own processes. This is enabled on a program-by-program basis, and must be explicitly enabled.

Depending on the use case (e.g., in cases where the program cannot or does not need to verify ownership), the ability to use PRENOTE to validate bank account information may be made available. Prenotes validate the information of the bank account but does not verify ownership.

Micro deposit verification

Micro deposit verification consists of three steps:

-

Your user provides information on the external bank account's owner and the bank account type and routing and account number. Program passes this information to Lithic with a

POSTrequest to/external_bank_accountswith theverification_methodset toMICRO_DEPOSIT. The external bank account enters averification_stateofPENDING. -

Lithic sends two small dollar deposits (totaling less than $2) to the external bank account and then immediately collects the sum of both amounts. Both the deposits and the collection can be seen in the external bank account in 1-2 business days.

-

Your user provides the two deposit amounts they see in their bank account, and the program passes this information to Lithic with a

POSTrequest toexternal_bank_accounts/{external_bank_account_token}/micro_deposits. If the amounts match, the external bank account will be verified and entered into averification_stateofENABLED.

If the incorrect micro deposit amounts are provided more than 5 times, then the external bank account will switch to a state of FAILED_VERIFICATION and can no longer be verified programmatically. You can reverify the account by calling the Retry external bank account via micro deposit endpoint.

Prenote verification

Prenote verification consists of three steps:

- Your user provides information on the external bank account's routing and account number. Program passes this information to Lithic with a

POSTrequest to/external_bank_accountswith theverification_methodset toPRENOTE, and the token of the operating account from which the prenote will originate. The external bank account enters averification_stateofPENDING. - Lithic automatically generates a prenote (i.e., a $0 credit) and sends it to the external bank account.

- Lithic lets two banking days pass after the settlement date of the prenote. If by the start of the third banking day no return is received, then that bank account is considered verified and enters into a

verification_stateofENABLED.

If a return is generated by the external bank account’s financial institution, then the bank account information is considered invalid, and the external bank account will switch to a state of FAILED_VERIFICATION and can no longer be verified programatically. You should confirm the bank account details with the end-user and go through the external bank account creation process again.

Externally Verified verification

If you are performing your own verification, Lithic permits External Bank Accounts to be created with method EXTERNALLY_VERIFIED. To use this option, Lithic will confirm your verification process during onboarding and must specifically enable this for your External Bank Accounts via configuration.

If you're verifying externally, wait until the account is fully verified before sending the POST request to /external_bank_accounts with the verification_method set to EXTERNALLY_VERIFIED. The external bank account will be created with a verification_state of ENABLED.

Unverified External Bank Accounts

In addition, External Bank Accounts may be instantiated as UNVERIFIED. Generally, this is not best practice and ACH Debit Originations will always be rejected to UNVERIFIED External Bank Accounts. The 2 cases where External Bank Accounts may be created as UNVERIFIED are:

- If the External Bank Account will only be used to originate ACH credits to, and you have received permission from Lithic during onboarding. This is also explicitly configured.

- If the External Bank Account will be verified at a later date. See the delayed verification sequence below.

External Bank Account Lifecycle

An External Bank Account has two lifecycles that are tracked by verification_state and state. The former indicates whether an external bank account has been verified by you and is generally finalized during initial set-up. The latter tracks the actual state of the external bank account throughout the lifetime of the account.

For example, an External Bank Account that has a verification_state of ENABLED and state of ENABLED indicates the account has been verified and can process ACH transactions. If the user decides to close their external bank account at their bank, the External Bank Account state will change to CLOSED, but its verification_state will remain ENABLED.

If an External Bank Account is created as UNVERIFIED, use the Set Verification Method endpoint to verify it at a later date.

External Bank Account Schema

{

"token": String,

"type": String,

"verification_method": String,

"owner_type": String,

"owner": String,

"state": String,

"verification_state": String,

"routing_number": String,

"last_four": String,

"name": String,

"currency": String,

"country": String,

"account_token": String,

"created": String,

"company_id": String,

"dob": Date,

"doing_business_as": String,

"address": Address,

"user_defined_id": String,

"verification_attempts": Integer,

"verification_failed_reason": String

}

| token | Globally unique identifier for this record of an external bank account. If an external bank account is linked to multiple end-user accounts or to the program and an end-user account, then Lithic will return each record of the association |

| type | CHECKING, SAVINGS |

| verification_method | MANUAL, MICRO_DEPOSIT, PRENOTE, EXTERNALLY_VERIFIED |

| owner_type | INDIVIDUAL, BUSINESS |

| owner | Legal Name of the business or individual who owns the external account. This will appear in statements |

| state | ENABLED, CLOSED, PAUSED |

| verification_state | PENDING, ENABLED, FAILED_VERIFICATION, RETURNED_VERIFICATION |

| routing_number | Routing number of your external bank account |

| last_four | The last 4 digits of the bank account. Derived by Lithic from the account number passed |

| name | The nickname given to this record of External Bank Account |

| currency | Currency of the external bank account in 3-digit alphabetic ISO 4217 code |

| country | The country that the external bank account is located in using ISO 3166-1. Lithic currently only accepts US bank accounts (US) |

| account_token | The Lithic end-user account that an external bank account is associated with. For external bank accounts that are associated with the program, account_token field returned will be null |

| created | Date and time of when this external bank account was associated with a Lithic end-user account or program |

| company_id | Unique identifier assigned to an external bank account by the bank. Lithic utilizes this information to manage ACH receipts |

| dob | Date of birth. Only applicable if the owner type is INDIVIDUAL |

| doing_business_as | Any name that the BUSINESS or INDIVIDUAL operates under that is not its legal business name (if applicable). |

| address | Business's physical address - PO boxes, UPS drops, and FedEx drops are not acceptable; APO/FPO are acceptable. Required only if the owner type is BUSINESS. See Address Schema. |

| user_defined_id | Additional metadata provided by customers that may help with reconciliation against other systems |

| verification_attempts | Number of attempts to verify external bank account |

| verification_failed_reason | Optional additional context behind a failed or returned verification. For micro-deposits that are returned by the ACH network, this field will be populated with the return reason code e.g. R01 |

Address Schema

| address1 | Valid deliverable address (no PO boxes) |

| address2 | Unit or apartment number (if applicable) |

| city | City name |

| state | Valid state code. Only USA state codes are currently supported |

| postal_code | Valid postal code. Only USA ZIP codes are currently supported |

| country | Country name. Only US is currently supported |

Create external bank account

ImportantLithic requires account and routing number to be unique:

- If

account_tokenis provided it must be unique per account- If no

account_tokenis provided it must be unique for a programAs a result, if an account is accidentally created with the wrong account/routing number combination you cannot update that external bank account; instead, you must create a new one.

In the event that the account/routing number already exists, a

409 Conflictwill be returned with a response containing the original token (see docs here).

POST https://api.lithic.com/v1/external_bank_accountsSample Request: Micro Deposit Verification

curl https://api.lithic.com/v1/external_bank_accounts \

-X POST \

-H "Authorization: YOUR_API_KEY" \

-H "Content-Type: application/json" \

-d '

{

"verification_method": "MICRO_DEPOSIT",

"financial_account_token": "f2f74f63-d4b3-4f51-b40e-7156b45a1e56",

"owner_type": "BUSINESS",

"owner": "John Doe LLC",

"type": "CHECKING",

"routing_number": "021000021",

"account_number": "123456789",

"name": "Funding Account",

"country": "USA",

"currency": "USD",

"address": {

"address1": "456 Main Street",

"city": "New York",

"state": "NY",

"postal_code": "10128",

"country": "USA"

}

}

'| Parameter | Description |

|---|---|

type (required) | Type of bank account; Lithic advises using checking accounts only String. Permitted values: CHECKING, SAVINGS |

verification_method (required) | MICRO_DEPOSIT, PRENOTE, or EXTERNALLY_VERIFIED |

financial_account_token (required) | Token representing the operating account that is originating the micro deposit or prenote. String. Permitted values: 36-digit version 4 UUID (including hyphens). |

owner_type (required) | Indicates whether bank account is a consumer or commercial account String. Permitted values: INDIVIDUAL, BUSINESS |

owner (required) | Legal Name of the business or individual who owns the external account String. Permitted values: 1-100 characters. |

routing_number (required) | Routing number of your external bank account String. Permitted values: Valid US Bank Routing Number. |

account_number (required) | Account number of your external bank account String. Permitted values: Valid US Bank Account Number. |

name (optional) | The nickname given to this record of external bank account String. Permitted values: 1-50 characters. |

currency (required) | Currency of the external bank account in ISO 4217 code String. Permitted values: USD. |

country (required) | The country that the external bank account is located in using ISO 3166-1. String. Permitted values: USA. |

account_token (optional) | The Lithic end-user account that the external bank account is associated with. String. Permitted values: 36-digit version 4 UUID (including hyphens). |

company_id (optional) | Unique identifier assigned to an external bank account by the bank. String. Permitted values: 1-10 characters. |

user_defined_id (optional) | Additional metadata provided by customers that may help with reconciliation against other systems String. Permitted values: 1-512 characters. |

dob (required) | Required only if the owner type is INDIVIDUALDate of birth. String. RFC 3339 format (yyyy-MM-dd). |

doing_business_as (optional) | Any name that the BUSINESS or INDIVIDUAL operates under that is not its legal business name (if applicable).String. |

address (required) | Required only if the owner type is BUSINESS.Business's physical address - PO boxes, UPS drops, and FedEx drops are not acceptable; APO/FPO are acceptable. Only USA addresses are currently supported. Object. Valid address object. |

Address Schema in Requests

| Parameter | Description |

|---|---|

address1 (required) | Valid deliverable address (no PO boxes) String. Max length 40 |

address2 (optional) | Unit or apartment number (if applicable) String. Max length 40 |

city (required) | City name String. Max length 40 |

state (required) | Valid state code. Only USA state codes are currently supported String. Entered in uppercase ISO 3166-2 two-character format |

postal_code (required) | Valid postal code. Only USA ZIP codes are currently supported String. Entered as a five-digit ZIP or nine-digit ZIP+4. |

country (required) | Country name. Only USA is currently supported String. ISO 3166-1 |

Sample Response

{

"token": "2da0a808-de12-4b42-b413-ca736d6892c5",

"type": "CHECKING",

"verification_method": "MICRO_DEPOSIT",

"owner_type": "BUSINESS",

"owner": "John Doe LLC",

"state": "ENABLED",

"verification_state": "PENDING",

"routing_number": "021000021",

"last_four": "6789",

"name": "Funding Account",

"country": "USA",

"currency": "USD",

"account_token": "4998a704-636f-4d79-97da-478ea19b152a",

"created": "2020-07-15T19:17:22Z",

"company_id": "0924752",

"user_defined_id": "ABC",

"verification_attempts": 1,

"verification_failed_reason": "",

"address": {

"address1": "456 Main Street",

"city": "New York",

"state": "NY",

"postal_code": "10128",

"country": "USA"

}

}Get external bank account

GET https://api.lithic.com/v1/external_bank_accounts/{external_bank_account_token}Sample Request

curl https://api.lithic.com/v1/external_bank_accounts/2da0a808-de12-4b42-b413-ca736d6892c5 \

-H 'AUTHORIZATION: YOUR_API_KEY'Sample Response

{

"token": "2da0a808-de12-4b42-b413-ca736d6892c5",

"type": "CHECKING",

"verification_method": "MICRO_DEPOSIT",

"owner_type": "BUSINESS",

"owner": "John Doe LLC",

"state": "ENABLED",

"verification_state": "PENDING",

"routing_number": "021000021",

"last_four": "6789",

"name": "Funding Account",

"country": "USA",

"currency": "USD",

"account_token": "4998a704-636f-4d79-97da-478ea19b152a",

"created": "2020-07-15T19:17:22Z",

"company_id": "0924752",

"user_defined_id": "ABC",

"verification_attempts": 1,

"verification_failed_reason": "",

"address": {

"address1": "456 Main Street",

"city": "New York",

"state": "NY",

"postal_code": "10128",

"country": "USA"

}

}| Parameter | Description |

|---|---|

external_bank_account_token (required, path parameter) | Globally unique identifier for the external bank account record that should be returned. String. Permitted values: 36-digit version 4 UUID (including hyphens). |

account_token (optional) | The Lithic end-user account that the external bank account is associated with. String. Permitted values: 36-digit version 4 UUID (including hyphens). |

owner_types (optional) | Query by types of owner Array of Strings. Permitted values: INDIVIDUAL, BUSINESS |

account_types (optional) | Query by types of external bank account Array of Strings. Permitted values: CHECKING, SAVINGS |

states (optional) | Query by states of external bank account Array of Strings. Permitted values: ENABLED, CLOSED, PAUSED |

verification_states (optional) | Query by verification states of the external bank account record Array of Strings. Permitted values: PENDING, ENABLED, FAILED_VERIFICATION |

countries (optional) | Query by countries using ISO 3166-1. Array of Strings. Permitted values: ISO 3166-1 code. |

page_size (optional, query parameter) | For cursor-based pagination - specifies the number of entries to be included on each page in the response. Default value is 100. Integer. Permitted values: 1-100. |

starting_after (optional, query parameter) | For cursor-based pagination - specifies the next object in a list to be returned. Requests can only use either starting_after or ending_before. For example, you have a list of 100 Financial Transaction objects where the first entry is UUID abcd and last entry is UUID wxyz. A request of starting_after = abcd and page_size = 100 will return 99 results (abcd is excluded from the response)String. Permitted values: 36-digit version 4 UUID (including hyphens). |

ending_before (optional, query parameter) | For cursor-based pagination - specifies the last object in a list to be returned. Requests can only use either starting_after or ending_before. For example, you have a list of 100 Financial Transaction objects where the first entry is UUID abcd and last entry is UUID wxyz. A request of ending_before = wxyz and page_size = 100 will return the full list of 100String. Permitted values: 36-digit version 4 UUID (including hyphens) |

Patch external bank account

PATCH https://api.lithic.com/v1/external_bank_accounts/{external_bank_account_token}Sample Request

curl https://api.lithic.com/v1/external_bank_accounts/2da0a808-de12-4b42-b413-ca736d6892c5 \

-X PATCH \

-H "Authorization: YOUR_API_KEY" \

-H "Content-Type: application/json" \

-d '

{

"owner": "John Doe INC",

"name": "Corporate Funds",

"company_id": "1234567",

}

'Sample Response

{

"token": "2da0a808-de12-4b42-b413-ca736d6892c5",

"type": "CHECKING",

"verification_method": "MICRO_DEPOSIT",

"owner_type": "BUSINESS",

"owner": "John Doe INC",

"state": "ENABLED",

"verification_state": "PENDING",

"routing_number": "021000021",

"last_four": "6789",

"name": "Corporate Funds",

"country": "USA",

"currency": "USD",

"account_token": "4998a704-636f-4d79-97da-478ea19b152a",

"created": "2020-07-15T19:17:22Z",

"company_id": "1234567",

"user_defined_id": "ABC",

"verification_attempts": 1,

"verification_failed_reason": "",

"address": {

"address1": "456 Main Street",

"city": "New York",

"state": "NY",

"postal_code": "10128",

"country": "USA"

}

}| Parameter | Description |

|---|---|

external_bank_account_token (required, path parameter) | Globally unique identifier for the external bank account record that should be patched. String. Permitted values: 36-digit version 4 UUID (including hyphens). |

owner_type (optional) | INDIVIDUAL, BUSINESS |

owner (optional) | Legal Name of the business or individual who owns the external account String. Permitted values: 1-100 characters. |

name (optional) | The nickname given to this record of external bank account String. Permitted values: 1-50 characters. |

company_id (optional) | Unique identifier assigned to an external bank account by the bank. String. Permitted values: 1-10 characters. |

dob (optional) | Date of birth. String. RFC 3339 format (yyyy-MM-dd). |

doing_business_as (optional) | Any name that the BUSINESS or INDIVIDUAL operates under that is not its legal business name (if applicable).String. |

user_defined_id (optional) | Additional metadata provided by customers that may help with reconciliation against other systems String. Permitted values: 1-512 characters. |

address (optional) | Business's physical address - PO boxes, UPS drops, and FedEx drops are not acceptable; APO/FPO are acceptable. Only USA addresses are currently supported. Object. Valid address object. |

type (optional) | Can only be updated when verification_state is FAILED_VERIFICATION. Valid values: CHECKING, SAVINGS |

Account Type Updates for Failed Verification

When an external bank account is in a FAILED_VERIFICATION state, you can update its account type using the PATCH endpoint. This allows correction of account type misclassification that may have led to verification failure. Note: In the event that an external bank account was created with the wrong routing or account number you must create a new external bank account with the correct routing and account numbers.

{

"type": "SAVINGS" // Can be "CHECKING" or "SAVINGS"

}

Verify via micro deposit

If you are testing in sandbox, please enter the micro deposit amounts of 19 and 89.

POST https://api.lithic.com/v1/external_bank_accounts/{external_bank_account_token}/micro_depositsSample Request

To complete onboarding for an external bank account added via micro deposit verification, you will need your users to provide the two small-dollar amounts deposited into their bank account and submit these amounts to Lithic via a POST request similar to the one below:

curl https://api.lithic.com/v1/external_bank_accounts/2da0a808-de12-4b42-b413-ca736d6892c5/micro_deposits \

-X POST \

-H "Authorization: YOUR_API_KEY" \

-H "Content-Type: application/json" \

-d '

{

"micro_deposits": ["19", "89"]

}

'Sample Response

If the amounts posted match the amounts deposited, the verification_state of the external bank account will update to ENABLED:

{

"token": "2da0a808-de12-4b42-b413-ca736d6892c5",

"type": "CHECKING",

"verification_method": "MICRO_DEPOSIT",

"owner_type": "BUSINESS",

"owner": "John Doe INC",

"state": "ENABLED",

"verification_state": "ENABLED",

"routing_number": "021000021",

"last_four": "6789",

"name": "Corporate Funds",

"country": "USA",

"currency": "USD",

"account_token": "4998a704-636f-4d79-97da-478ea19b152a",

"created": "2020-07-15T19:17:22Z",

"company_id": "1234567",

"user_defined_id": "ABC",

"verification_attempts": 1,

"verification_failed_reason": ""

}| external_bank_account_token (required, path parameter) | Globally unique identifier for the external bank account record that needs to be verified via micro deposits String. Permitted values: 36-digit version 4 UUID (including hyphens). |

| micro_deposits (required) | The two deposits (totaling less than $1) that your users see in their bank accounts. Array of Strings Permitted values: two values. |

Events API and Webhooks

You can receive notification of External Bank Account events by subscribing to the following event types in the Events API:

external_bank_account.created: notification that an external bank account resource has been createdexternal_bank_account.updated: notification that an external bank account has been updated e.g., name change

Managing External Bank Account Statuses

Lithic automatically updates External Bank Account statuses based on the ACH return codes we receive. See our ACH return reasons page to learn more.

Updated 5 months ago